What is the purpose of crypcore?

Cryptocurrency with stable coins to solve the problem of volatility. After joining the cryptocurrency room, stable coins have worked well, but many improvements are still running. Priority in the field of crypto-mortgage coins. This white paper discusses how to make strong combinatorial coins with cryptography that deals with clean crypto exchangers, solvent systems, and cryptonote protocols. Crypcore is Releasing Crypto Assets that provides a solvency system that removes price volatility and allows Crypcore to grow. Crypcore upon approval of a digital cryptocurrency asset with a payment system for price approval.

presentation

Blockchain is a well thought out development - a product made personally or by people who are supported, known by the pseudonym Nakamoto. How, since that time it has changed into something more visible, and the main question everyone asks: what is a blockchain?

Due to the fact data continues to be provided, but not duplicated, launched in the blockchain It has been made the basis for other types of networks. Originally created for advances, Buy Bitcoin, the technology network is now discovering other potential uses for innovation.

Bitcoin has been approved as "further gold," and for reasonable justification. To date, US $ 112 billion. In addition, blockchain can make various types of computerized. Like on the Internet (or in your vehicle), you don't need to know how the blockchain is trying to use. However, information that needs to be improved about this must be corrected which is considered progressive. In this case, I hope you will continue this before continuing.

What exactly is cypcore

Problems and solutions

Too much power on the part of the publisher: the issuer cannot use stable coins at any time. For example, the Omni Tether protocol can provide and revoke tokens and appear on the blockchain. Crypcore is not possible because of the core technology of Crypcore.

Reprinted. The big problem with the most stable coins is that they are issued in the same way as a central bank issuing money. This makes them vulnerable to excess emissions and vulnerable to emissions. This is a cryptonote logical protocol and can be seen by everyone.

Virtual deposits are not stable: virtual deposits themselves are unstable, needed to back up coins that are stable and difficult. At the end of this document, you can see how Crypcore works to solve this problem.

This is strictly regulated: coins are stable with binding

Liquidation and expensive and slow purchases: With the most stable coin provider, stable coin liquidation can be slowed down because you need to link money to your account to pay bank fees. Sometimes you need to buy money through the KYC process, so your purchase may need to be faster.

Sophisticated smart contracts: encrypted digital mortgage assets such as Dai Maker increase the difficulty of understanding. For end-users everyday, the conditions seem too complicated. Crypcore implements a system of analytic equations that is very easy with equations and parameters that are easy to understand.

Crypcore is a unique stable coin, the value of cryptocurrency will change over time depending on the economy, unlike ordinary stable coins, cryptocurrency will not work. A structured cryptocurrency biological system that allows the liability to fluctuate in cryptocurrency.

Problems and solutions

Excessive intensity issued by the issuer: stable coins can be removed from distribution at any time by any serving association. For example, communication protocols that can be activated and approved by tokens that are related to the blockchain. With Crypcore, this is done to discuss the Crypcore being done.

Excessive emission. The big problem with the most stable coins is that they are given the same way in issuing money by national banks, which makes them powerless against excessive emissions and powerlessness to develop. Crypcore will not have problems with the reason it is available for use. dictated by the reasons behind the emanation of the cryptonote convention and is clear to everyone.

Temperamental virtual software: Virtual software itself is unstable, needed to support stable coins and problems. Before you complete this article, you will complete Crypcore wanting to solve this problem.

Regulated in general: Fiat stable coins are driven by management and transferred on the basis of banking inheritance.

Expensive, fast liquidation and purchases. Eliminating stable coins can be a moderate one that requires suppliers that your most stable coin supplier must transfer money to your account, which will cause bank fees. Buying can also be postponed, because you sometimes need to try the KYC method and transfer money, which can sometimes take days.

Sophisticated smart contract: There is a problem for Cryptocurrency computing resources such as Dai Maker. For ordinary customers, conditions may seem extraordinary. Crypcore will ask for basic solubility structural requirements with immediate requirements and parameters.

Bad anonymity with stable coins: stable coins do not provide stealth levels.

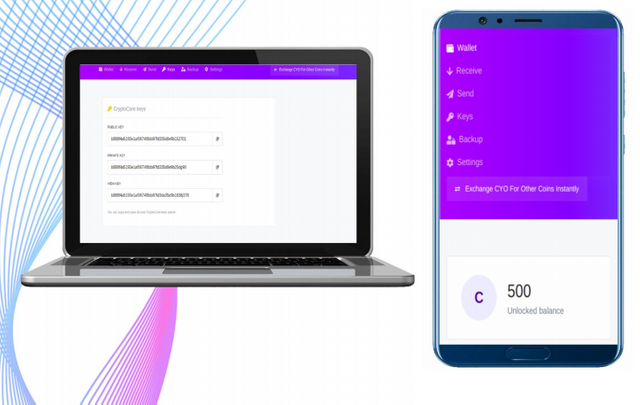

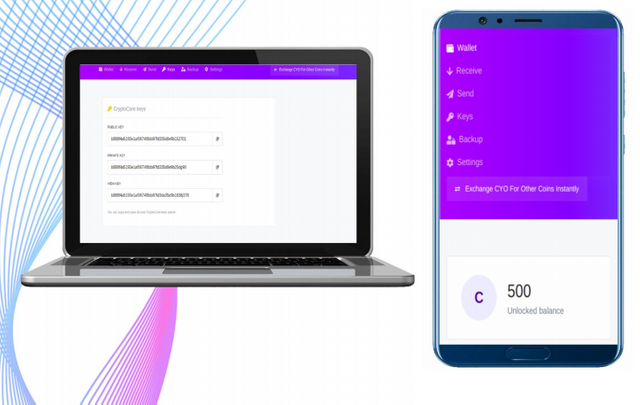

Crypcore wallet

Crypcore can only be accessed specifically for non-specialists, the wallet will provide a variety of drinks. There will be a work area wallet, reference wallet, equipment wallet and web wallet. After the Web Wallet climax, wallets for Android and iPhone will start to improve. Web wallet under construction, you can see a screenshot below.

How does crypcore work?

Crypcore is taken from Monero, based on the cryptonote agreement that safely operates cryptography and is completely unknown, crypcoreecosystem combines solubility conditions, the original cryptocurrency and cryptonote agreement for the review of making coins that have a stable value with stability value achieved with an average increase in guarantee with value deviations.

With this effect, Crypcore is a stable coin that works at the original level and is different from ordinary stable coins, we will consider it a dynamic stable coin (DSC). Crypcore will receive fees from those related to Crypcore, these fees will be added to the Crypcore coin insurance, therefore, the Guarantee will continue to increase and the reasonable price will not be fixed.

Crypcore system

The famous stable coin is pegged to the US dollar and has a ratio of 1: 1; Crypcore, on the other hand, will not be pegged at 1: 1, but will determine the value of the Guarantee. From this perspective, Crypcore cannot be considered a stable coin in the traditional sense of the word. Crypcore will consist of several free parts to support the cost of Crypcore coins: Crypcore Blockchain, Crypcore Mining, Crypcore Wallet and Crypcore Instantexchange.

Crypcore exchange

Crypcore Trading will take up significant work in Crypcore fees. To do this, everything on Crypcore Exchange has to be done in luxury. Very simple solubility conditions will determine the crypt score. In a typical stable coin, tokens are given by a significant association, but in trading cryptocurrency, tokens cannot be made, each coin is required.

This is because the fact that protecting and protecting our customers is very important. With the ultimate goal for Cryps to maintain its value, most of the money is mined and held by Crypcore trading. Crypts held by trade will not be considered available for use. Crypcore trading is currently an unknown trading moment. This is a screenshot of the deal.

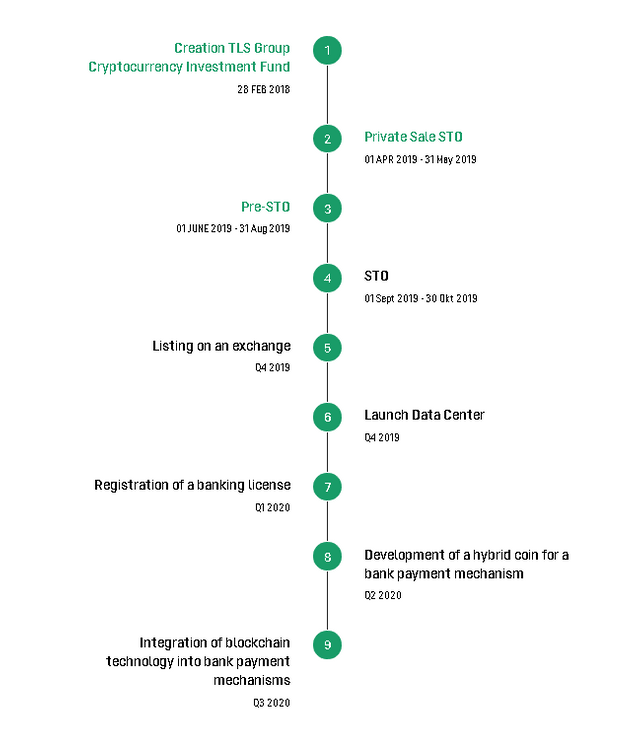

Project road map

Q2 2019 - Realization & Research Ideas

Personal funding $ 50,000 Q3 2019 - Architectural design and publication Q4 2019 Technical Documents - Launch of Crypcore Instant Launch Launch of Explorer block Starting trade of cryptocurrency transportation Q1 2020 - Launch of Dom Q2 2020 Wallet - Pelunpetuun

more detailed information can visit the site below?

WEBSITE

WHITE PAPER

TELEGRAM

FACEBOOK

TWITTER

REDDIT

TELEGRAM BOUNTY

AUTHOR: hogriderr

BTT PROFILE: (hogriderr)

ETH ADDRESS: 0xa6e13d101FAc22dEE3e2F50fBfaa575511BB9Cce

Read more...

Cryptocurrency with stable coins to solve the problem of volatility. After joining the cryptocurrency room, stable coins have worked well, but many improvements are still running. Priority in the field of crypto-mortgage coins. This white paper discusses how to make strong combinatorial coins with cryptography that deals with clean crypto exchangers, solvent systems, and cryptonote protocols. Crypcore is Releasing Crypto Assets that provides a solvency system that removes price volatility and allows Crypcore to grow. Crypcore upon approval of a digital cryptocurrency asset with a payment system for price approval.

presentation

Blockchain is a well thought out development - a product made personally or by people who are supported, known by the pseudonym Nakamoto. How, since that time it has changed into something more visible, and the main question everyone asks: what is a blockchain?

Due to the fact data continues to be provided, but not duplicated, launched in the blockchain It has been made the basis for other types of networks. Originally created for advances, Buy Bitcoin, the technology network is now discovering other potential uses for innovation.

Bitcoin has been approved as "further gold," and for reasonable justification. To date, US $ 112 billion. In addition, blockchain can make various types of computerized. Like on the Internet (or in your vehicle), you don't need to know how the blockchain is trying to use. However, information that needs to be improved about this must be corrected which is considered progressive. In this case, I hope you will continue this before continuing.

What exactly is cypcore

Problems and solutions

Too much power on the part of the publisher: the issuer cannot use stable coins at any time. For example, the Omni Tether protocol can provide and revoke tokens and appear on the blockchain. Crypcore is not possible because of the core technology of Crypcore.

Reprinted. The big problem with the most stable coins is that they are issued in the same way as a central bank issuing money. This makes them vulnerable to excess emissions and vulnerable to emissions. This is a cryptonote logical protocol and can be seen by everyone.

Virtual deposits are not stable: virtual deposits themselves are unstable, needed to back up coins that are stable and difficult. At the end of this document, you can see how Crypcore works to solve this problem.

This is strictly regulated: coins are stable with binding

Liquidation and expensive and slow purchases: With the most stable coin provider, stable coin liquidation can be slowed down because you need to link money to your account to pay bank fees. Sometimes you need to buy money through the KYC process, so your purchase may need to be faster.

Sophisticated smart contracts: encrypted digital mortgage assets such as Dai Maker increase the difficulty of understanding. For end-users everyday, the conditions seem too complicated. Crypcore implements a system of analytic equations that is very easy with equations and parameters that are easy to understand.

Crypcore is a unique stable coin, the value of cryptocurrency will change over time depending on the economy, unlike ordinary stable coins, cryptocurrency will not work. A structured cryptocurrency biological system that allows the liability to fluctuate in cryptocurrency.

Problems and solutions

Excessive intensity issued by the issuer: stable coins can be removed from distribution at any time by any serving association. For example, communication protocols that can be activated and approved by tokens that are related to the blockchain. With Crypcore, this is done to discuss the Crypcore being done.

Excessive emission. The big problem with the most stable coins is that they are given the same way in issuing money by national banks, which makes them powerless against excessive emissions and powerlessness to develop. Crypcore will not have problems with the reason it is available for use. dictated by the reasons behind the emanation of the cryptonote convention and is clear to everyone.

Temperamental virtual software: Virtual software itself is unstable, needed to support stable coins and problems. Before you complete this article, you will complete Crypcore wanting to solve this problem.

Regulated in general: Fiat stable coins are driven by management and transferred on the basis of banking inheritance.

Expensive, fast liquidation and purchases. Eliminating stable coins can be a moderate one that requires suppliers that your most stable coin supplier must transfer money to your account, which will cause bank fees. Buying can also be postponed, because you sometimes need to try the KYC method and transfer money, which can sometimes take days.

Sophisticated smart contract: There is a problem for Cryptocurrency computing resources such as Dai Maker. For ordinary customers, conditions may seem extraordinary. Crypcore will ask for basic solubility structural requirements with immediate requirements and parameters.

Bad anonymity with stable coins: stable coins do not provide stealth levels.

Crypcore wallet

Crypcore can only be accessed specifically for non-specialists, the wallet will provide a variety of drinks. There will be a work area wallet, reference wallet, equipment wallet and web wallet. After the Web Wallet climax, wallets for Android and iPhone will start to improve. Web wallet under construction, you can see a screenshot below.

How does crypcore work?

Crypcore is taken from Monero, based on the cryptonote agreement that safely operates cryptography and is completely unknown, crypcoreecosystem combines solubility conditions, the original cryptocurrency and cryptonote agreement for the review of making coins that have a stable value with stability value achieved with an average increase in guarantee with value deviations.

With this effect, Crypcore is a stable coin that works at the original level and is different from ordinary stable coins, we will consider it a dynamic stable coin (DSC). Crypcore will receive fees from those related to Crypcore, these fees will be added to the Crypcore coin insurance, therefore, the Guarantee will continue to increase and the reasonable price will not be fixed.

Crypcore system

The famous stable coin is pegged to the US dollar and has a ratio of 1: 1; Crypcore, on the other hand, will not be pegged at 1: 1, but will determine the value of the Guarantee. From this perspective, Crypcore cannot be considered a stable coin in the traditional sense of the word. Crypcore will consist of several free parts to support the cost of Crypcore coins: Crypcore Blockchain, Crypcore Mining, Crypcore Wallet and Crypcore Instantexchange.

Crypcore exchange

Crypcore Trading will take up significant work in Crypcore fees. To do this, everything on Crypcore Exchange has to be done in luxury. Very simple solubility conditions will determine the crypt score. In a typical stable coin, tokens are given by a significant association, but in trading cryptocurrency, tokens cannot be made, each coin is required.

This is because the fact that protecting and protecting our customers is very important. With the ultimate goal for Cryps to maintain its value, most of the money is mined and held by Crypcore trading. Crypts held by trade will not be considered available for use. Crypcore trading is currently an unknown trading moment. This is a screenshot of the deal.

Project road map

Q2 2019 - Realization & Research Ideas

Personal funding $ 50,000 Q3 2019 - Architectural design and publication Q4 2019 Technical Documents - Launch of Crypcore Instant Launch Launch of Explorer block Starting trade of cryptocurrency transportation Q1 2020 - Launch of Dom Q2 2020 Wallet - Pelunpetuun

more detailed information can visit the site below?

WEBSITE

WHITE PAPER

TELEGRAM

TELEGRAM BOUNTY

AUTHOR: hogriderr

BTT PROFILE: (hogriderr)

ETH ADDRESS: 0xa6e13d101FAc22dEE3e2F50fBfaa575511BB9Cce